At the March 17, 2022 Francis Howell Board of Education meeting, information surrounding the latest Prop S bond issue was made available. During this portion of the meeting it was relayed to the district that we were able to significantly reduce our bond interest rates due to such high demand for our bonds.

Mr. Supple (district CFO) attributed this to:

- “being a good day in the bond market”

- “the reputation of Francis Howell”

We even had the Managing Director of Public Finance from Stifel, our underwriter, come and reassure the board and those watching of how amazing this was for the district.

Today I want to review what didn’t get discussed through all the story and narrative — the actual figures from the bond issue. All information is available in detail on BoardDocs.

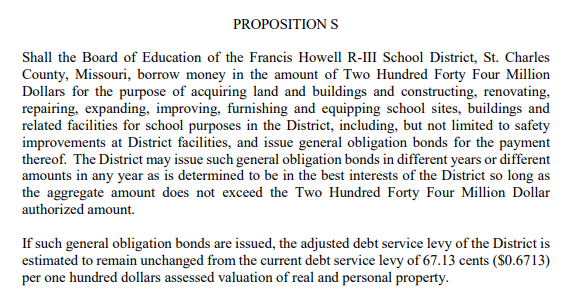

Above is a portion of information from the ‘Results Memo’ created by Stifel. A few things should stick out here, the ‘Par Amount’ of the bond, this is also known as the face or issuance value. This is the amount remaining to be authorized by Prop S. What you also see is the Project(ed) Fund Deposit, or what we expected to gain from this issuance — which is an additional $24 Million!

How can this be, and does it even matter? Afterall we ‘reduced our interest’ so it’s all good. But in reality our interest rate never changes, because it’s set at issuance along with par value. We are being shown a comparison of two different interest rates as if they were the same. One is the so called ‘True Interest Cost’ which is a mathematically adjusted rate based off the issuance rate. The issuance rate is the rate we promised to pay on the original $146 Million.

What we really got is a Bond with a set interest rate and an upfront payment from those most wanting to invest. We are being paid to offer a higher rate of interest than the market is requiring and being paid by the investors to do so. Theoretically, we should be paying the same rate of interest on the original $146 Million ‘Par’ amount. The fact that this is listed in the Pre-Pricing (prior to the bond actually going to market) means this was the plan all along. This was not some lucky chance caused by a good day in the market!

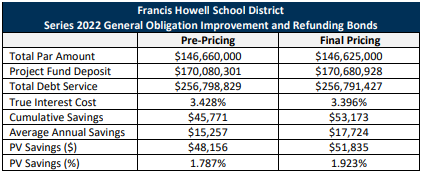

You may be thinking…hold on a minute, Mr. Supple said they didn’t have their pre-pricing call until “about 8:30 am” the morning of the board meeting, this couldn’t have been pre-meditated. For this I submit a segment of the districts, ‘Bond Resolution’.

Based on this, there was full intention to gain almost 19% more funds though a ‘Premium Bond’, acknowledging we are just pulling forward excessively high interest rates into an upfront payment. Though apparently legal, I don’t think this is what the taxpayers had in mind when they voted on a $244 Million bond issue. This is neither transparent or honest, and certainly doesn’t contribute to educating or building trust within the district — especially if the district needs to pass future tax issues.

And, it can’t be said no one on the board knew…

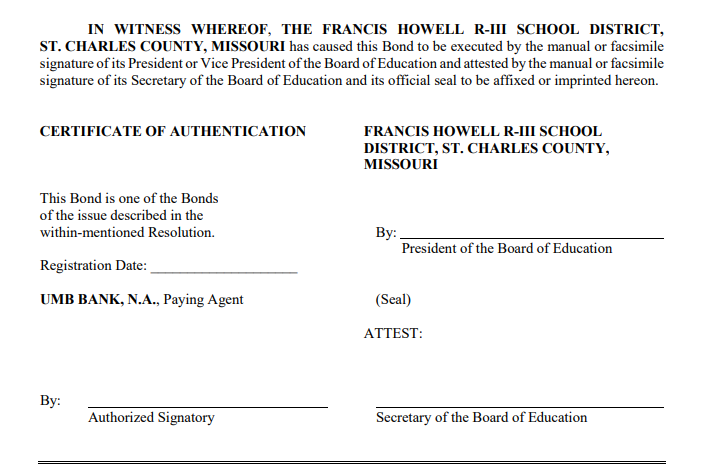

If you need a refresher on what was actually voted for with Prop S, here you go: